Rivian (Rivn) hit its intention to earn a great advantage in the fourth quarter. The Deviciary issued its fourth quarter after the market was closed on Thursday. Here's the full R4Iian financial deterioration of R4 2024.

Rivian reaches the perfect initial benefit in Q4 2024

Yesterday, in the view of our Q4 permission

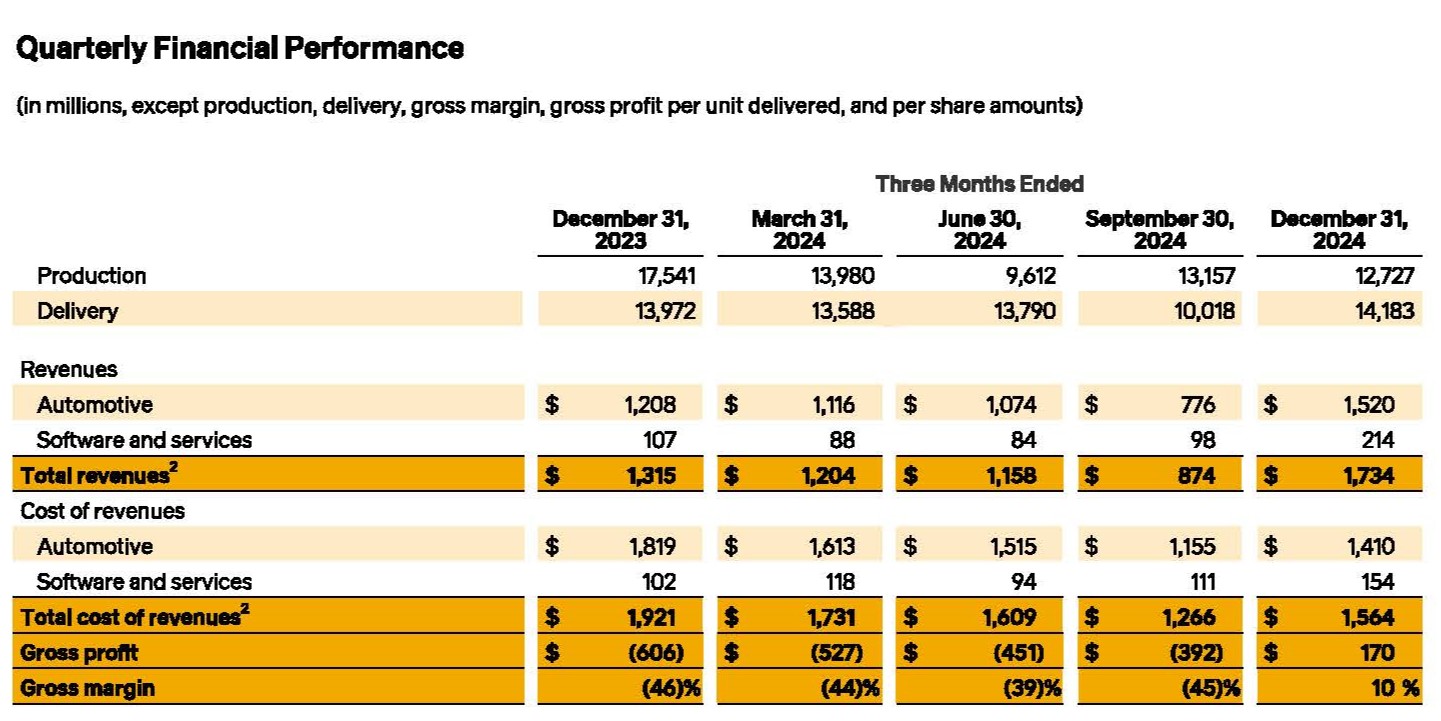

Rivian bombed their purpose, sent a large benefit of $ 170 million to a quarter of 776 million from Q4 2023. For them, some $ 60 million appeared in software and services.

Low costs, including each car brought, drove success. In addition to the development of plants, Rivian witnessed the development of material costs after presenting its second generation models.

Rivian has sent a fourth quarter of the fourth anniversary of $ 1.73 billion, Topping Wall expected $ 1.4 billion. The total of motor vehicle was $ 1.50 billion, mainly from 14,183 rivian cars sold in a quarter. Rivian also released $ 299 million from the sale of control cards and $ 484 million from software and services.

- Rivian Q4 2024 income: $ 1.73 billion vs $ 1.4 billion expected

- Rivian Q4 EPS losses: 0.46 per loss of assignment vs 0.68 per losses expected

“This is why,” we got a good benefit and removes $ 31,000 at the expense of sale car by Q4 2023 related to Q4 2023.

Rivian produced $ 110 million for quarterly quarterly losses of $ 611 million in Q4 2023. A year full of $ 7 million, loss of 2023 million.

The EV manufacturer produced 49,476 vehicles at its normal time, the IL plant last year and brought to 51 579. -Azon. Earlier this month, Rivian reblogged its clients' orders of the Amazon Consumer.

Rivian has sent a complete loss of $ 743 million to the fourth quarter, from more than $ 1.5 billion lost in Q4 2023. Full year, from $ 5.43 billion in 2023.

The next growth stage

In the fourth quarter, Rivian also closed the joint EV and Volkswagen. This agreement is eligible for up to $ 5.8 billion, where Rivian said Rivian $ 3.5 billion is expected to be accepted in the coming few years. Rivian will provide its own Developments and the National Volkswagen models.

The first will be Rivian's MidSising R2, a small SUV, inexpensive SUV. It will start about $ 45,000, or approximately part of the current R1S ($ 77,700) and R1T ($ 711,700).

The Rivian programs for the first R2 production in the general heat of the next year, but are expected to increase the most new production crop in Georgia.

Although its loan agreement with the US DOE to $ 6.6 billion before Trump has taken offices last month, Georgia Gov Brian Kemp said the week was sure where the money stopped.

Rivian is still confident that money will be available when they draw the next year. The strategies include building a plant in two phases, each adds 200,000 units of energy. R2 R2 is coming to Rivian and R3 for the smallest “critical drivers in the long and profitable growth.”

The company said on Thursday loan and a great fee from VW partnerships, over its current financial and equality, “is expected to give a number of services to pay for the Ramp, and the Midzelka's Georgia as well as meaningful level. “

Rivian still focuses on cutting costs, improving efficiency, and introducing R2 Electric SUV for R2. First R2 Development vehicles have just completed winter test. At that time, Irivian currently increases its normal production plant to prepare a new model.

Scaringa said, “I couldn't be happier for R2, and I believe skills combination and cost the wonders from customers, will make R2 a truly variable of Rivian.”

| Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Full year in 2024 | 2025 guidance | |

| Delivering | 13,588 | 13,7900 | 10,018 | 14,183 | 51,579 | 46,000 – 51,000 |

| Product | 13,980 | 9,612 | 13,157 | 12,727 | 49,476 | N / a |

Apart from this, Rivian expects lower than 46,000 and 51,000 delivery in 2025 because of external features, including policies and governments. After bringing many EMAZON EDVs to Q4, Rivian expects a low volume by 2025

The company awaits the repaired Ebitda loss between $ 1.7 billion and $ 1.9 billion, have large costs for $ 1.6 billion billion to $ 1.7 billion billion.

With “purpose”, including effective performance and converting costs, more than the highest sales amounts of Tri-Motor beating its market, Rivian expects to achieve the greatest benefit of 2025.

Rivian finished a quarter with $ 7.7 billion in cash and equality. Including one capital, the company ended a year for more than $ 9 billion in liquidity.

Check back to get many updates from Rivian-Quart Realings Fall. We will send the updates below.

FTC: We use income that receives compatible auto links. More.