With plans to significantly reduce its workforce, Ford's future in Germany looks bleak. According to Germany's biggest union, the new job cuts at Ford “will mean increasing death” to their future in Cologne.

Ford's job is cutting off the spark of German backsliding

On November 20, Ford announced plans to cut another 4,000 jobs in Europe by the end of 2027. Most of them will be in Germany, about 2,900 positions eliminated.

The move comes after Ford suffered “significant losses” in recent years amid “significant disruption” from new competition, particularly electric models. Ford blames slower-than-expected demand for its EVs and a sluggish economy for the cuts.

According to a German newspaper AutomobilwatchFord's job cuts are now being discussed among members of the economic committee of the state parliament in North Rhine-Westphalia.

SPD parliamentary group leader Jochen Ott said, “The job cuts announced on November 20 are a violation of the agreement reached in February 2023.” Ott added that the lack of confidentiality and late information provided by the labor council is “a clear breach of trust and a slap in the face.”

Germany's largest trade union, IG Metall, even agreed, saying the plans were a “significant threat to the continued existence” of Ford's remaining German plants.

Ford is still the biggest employer in Cologne, but it will cut about one in four of its current 12,000 jobs by the end of 2027. At that time, the American car company will have cut its workforce in half in just ten years.

Two electric models, the Explorer and Capri EVs, are built in Cologne, but a lack of demand is forcing Ford to cut production. Ford began building the Capri EV models last month after the electric Explorer in June.

Electrek's Take

Ford is finding it difficult to continue with European games as new competition has entered the market. With China awash in low-cost EVs, domestic automakers are looking overseas for growth, and Europe is one of the biggest targets.

BYD, MG, NIO, and others are launching new EV models aimed at European consumers. After pushing moribund automakers like Ford, VW, and Toyota out of their home market, China's EV leaders are now seeking a bigger share of the global market.

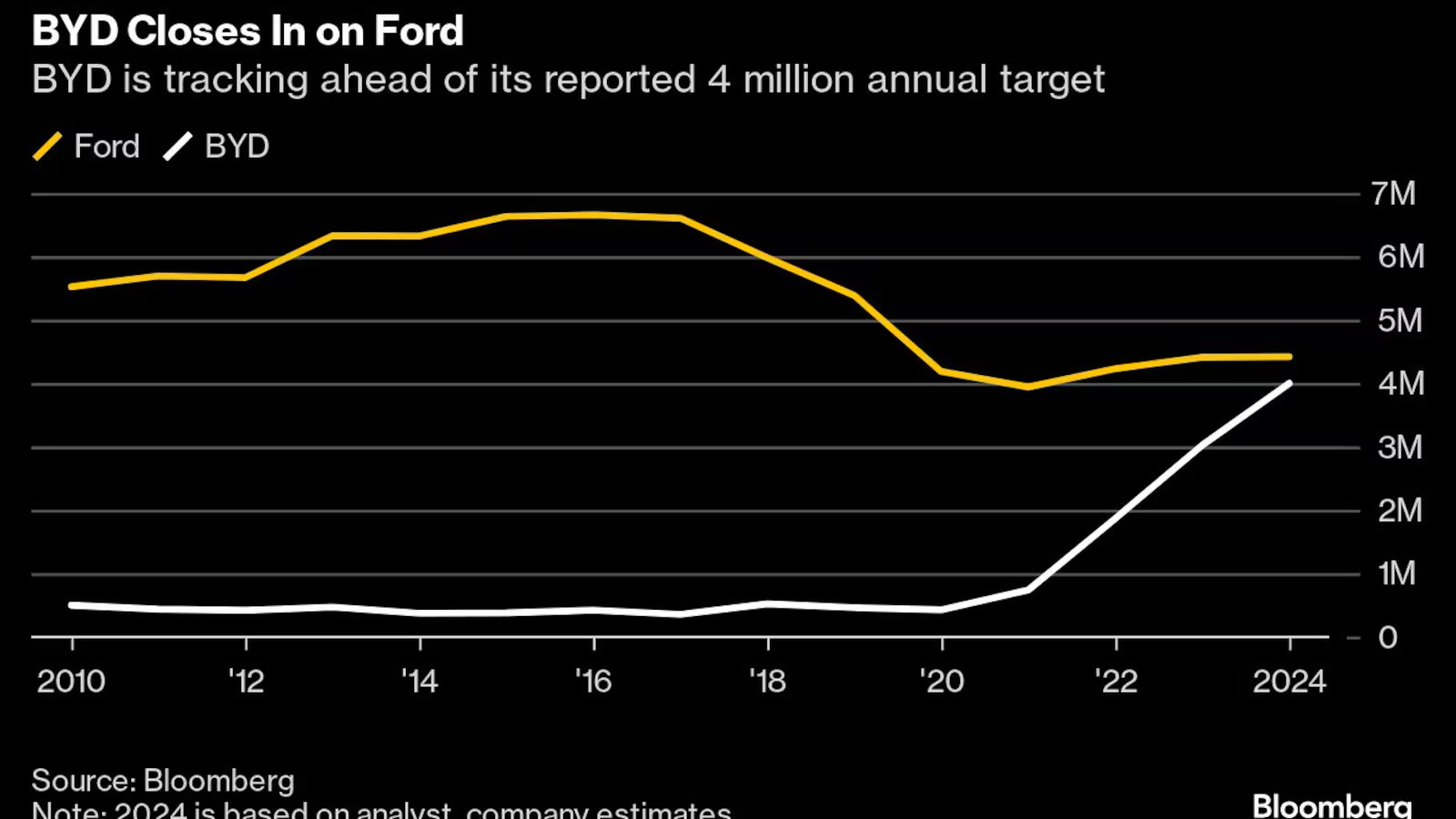

As its sales record continues, BYD has overtaken Nissan and Honda for the first time in global deliveries this year. Now, it's closing at Ford.

According to the latter Bloomberg Reportedly, BYD is fast closing in on Ford in global deliveries and could overtake the American automaker sooner than expected.

CEO Jim Farley acknowledged the threat of Chinese automakers, saying, “As the CEO of a company that has had trouble competing with Japan and South Korea, we have to fix this problem.”

Ford is shifting plans to focus on smaller, more profitable EVs with a new low-cost platform. However, the first model, an electric mid-size truck, won't hit the market until 2027. By then, it may be too little, too late.

FTC: We use auto affiliate links to earn income. More.