Japan's largest automaker is struggling as low-cost Chinese EV makers, such as BYD, continue to gain ground. Toyota's global production fell for the first time in four years in the first half of 2024. Is the company's slow shift to EVs to blame?

Toyota's global output declines amid slow EV transition

It's no secret that Toyota ranks among the industry leaders in electric vehicles.

The company built 4.71 million vehicles in the first quarter of fiscal 2024, down 7% from the record 5.06 million built last year. It is also the first time in four years that Toyota's production has decreased globally.

After halting production of the popular Yariss Cross and Corolla Fielder due to improper car certifications in Japan, Toyota's domestic production fell by 9.4% in the first half of the year.

Toyota says that the recall of the Prius hybrid has led to a decrease in production. Overseas Toyota production fell by about 6% to 3.17 million. In North America, volume decreased by 1.7%, while in Europe, volume increased by 3.2%.

Toyota was hit hard in China, with its output down 17%. Like many die-hard automakers, Toyota is struggling to keep up with Chinese EV leaders like BYD with its lowest-priced models.

BYD's cheapest EV, the Seagull, starts at less than $10,000 (69,800 yuan) and continues to top the sales charts.

Between April and September 2024, Toyota's global sales fell by 2.8% to 5 million units. This was the first decline in two years, with both domestic (-9.3%) and overseas (-1.6%) declines.

Although EV sales rose 32.5% to 78,178 units, Toyota has cut production plans for electric vehicles by 30% by 2026.

Toyota now expects to build about 1 million EVs by 2026, down from the 1.5 million they had previously targeted.

Electrek's Take

As one of the slowest automakers to transition to all-electric vehicles, Toyota is feeling the pressure. And it's not just in China.

Chinese EV makers, such as BYD, are expanding rapidly overseas as the domestic market is flooded with lower-priced rivals.

BYD launched its third EV in Japan this summer, the Seal, which is often compared to Tesla's Model 3. The Seal joins the Dolphin and Atto 3, BYD's two best-selling EVs. Starting at around $24,500 (¥3.63 million), the Dolphin EV is a direct threat to the Toyota Prius and Nissan LEAF.

Earlier this month, the Central Japan Economic and Trade Bureau held a meeting (via Nikkei) to examine trends in the EV industry.

The event featured about 90,000 parts from 16 foreign car manufacturers, and about 70 auto parts companies were present.

BYD's Atto 3 electric SUV, which starts at under $20,000 (140,000 yuan) in China, stole the show. Another guest asked, “How can it be done at such a low price?”

On Wednesday, BYD reported record Q3 revenue and profit as vehicle sales continued to climb to new highs.

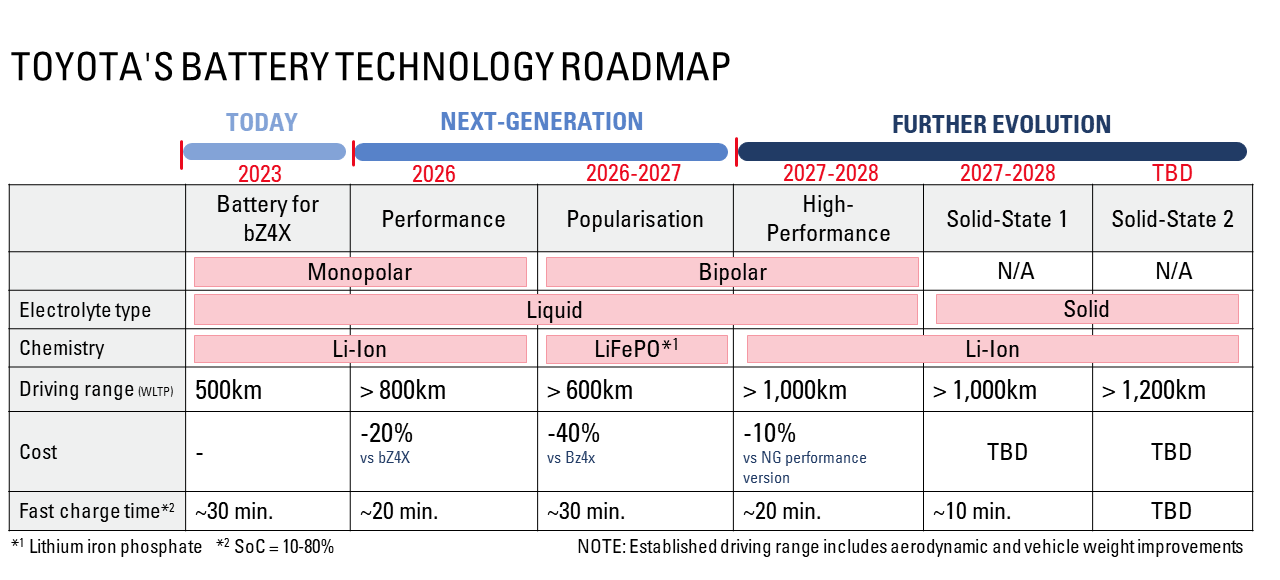

With Toyota promising its next-generation batteries will power efficient, low-cost EVs, will it be too little? The company says the LFP “Popularisation” batteries, due out in 2027, will provide a WLTP driving range of more than 373 miles (600 km).

According to the data from CnEPPostBYD made about a third of the LFP batteries installed in China in September. In China, LFP batteries make up about 75% of the market.

Source: Toyota, Kyodo News

FTC: We use auto affiliate links to earn income. More.